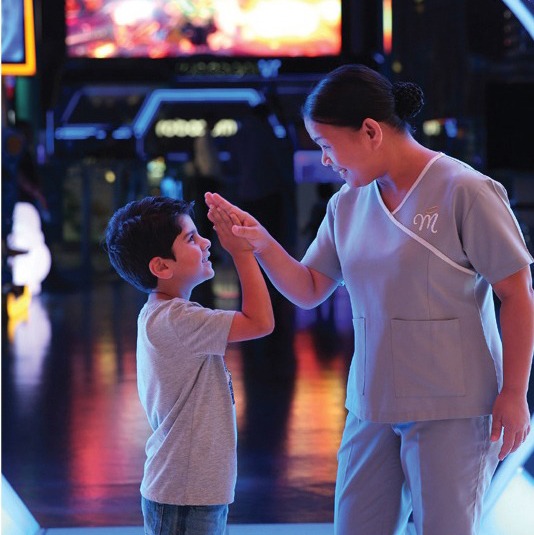

The Ascendance Of Luxury Short Stay Rentals

The landscape of travel and accommodation is undergoing a remarkable transformation with the surge in popularity of luxury short stay rentals. Discerning travelers seeking opulence and exclusivity are increasingly turning to these high-end properties, which offer an unparalleled level of comfort, privacy, and sophistication. Let’s define the reasons behind the rise of Dubai short stay […]

Posted on October 17, 2023